- #ANNUAL INCOME VS LIQUID NET WORTH PDF#

- #ANNUAL INCOME VS LIQUID NET WORTH PLUS#

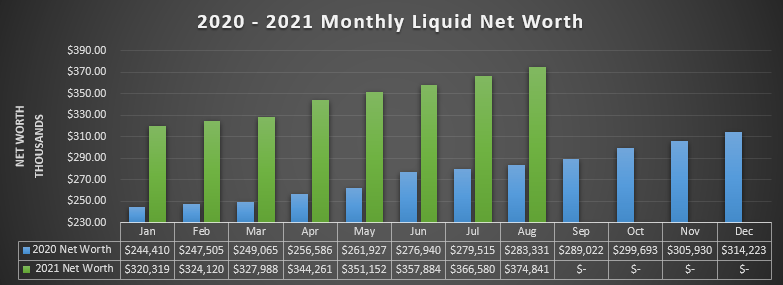

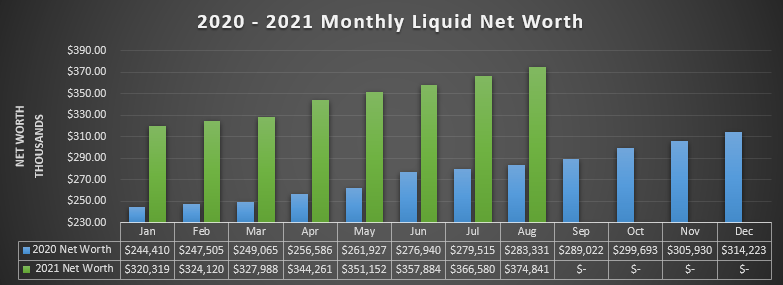

Reductions in wealth for the least wealthy were largely driven by higher-than-average increases in debt, while younger households (under 45 years) were affected more by declining real estate values, as these households tend to depend more on housing as a source of wealth than older households. The latest estimates from the distributions of household economic accounts reveal that net worth (wealth) decreased for a broad range of households in the second quarter, but especially for the most vulnerable, including the least wealthy ( -12.0%) and households younger than 45 years ( -8.2%).

#ANNUAL INCOME VS LIQUID NET WORTH PDF#

Attracting the mass-affluent, - Selected Tables Related information Previous release PDF (229 KB). MasterCard Analysis of Mass-Affluent Consumers Reveals Importance of Customization, PaymentsNews. Wealth Management: The Race to Serve the Mass Affluent, FinanceTech. You're Not Rich, but Now You Can Fake It, Slate. Trading Up: Why Consumers Want New Luxury Goods- and How Companies Create Them, Portfolio. Silverstein, Michael J., and Neil Fiske. Mass Affluence: Seven New Rules of Marketing to Today's Consumer, Harvard Business School Press. ^ "US Federal Reserve, Wealth in the US" (PDF). ^ a b Mass Affluent Investors Appear at Significant Risk Should Real Estate Bubble Burst, Spectrum Group. Disrupt Together: How Teams Consistently Innovate.

Archived from the original on 8 April 2005.

^ "Schwab: Courting the mass affluent". They spend between $4,000 and $10,000 per month in retirement. The mass affluent will have between US$500,000 and $1.5 million in investable assets upon retirement with a net worth between $500,000 and $2.5 million. They often wish to leave an inheritance to their children. The mass affluent generally may worry about replacing their paycheck in retirement, and may need to be encouraged to spend more money during their retirement years. While they worry about funding their children's college education, they realize other savings and loan options exist and they are not opposed to their children paying some part of their educational costs. The mass affluent have been characterized as those who save more than they spend and invest for their future. This is because liquid assets provide more financial flexibility, which is a desirable trait in customers.

Fixed assets such as real estate are not commonly counted.

As opposed to households with above average incomes the mass affluent are also defined through liquid assets such as stocks, bonds, cash, and mutual funds. Both terms refer to people whose wealth or income is above the average, yet below the top. Social class is the result of a person's function within society rather than merely the income of the household in which he or she resides. There may be a high correlation between the households in the upper-middle reaches of the income strata and the mass affluent, but there are differences. Mass affluent consumers are an important target market for sellers of luxury goods.ĭifference from upper middle income

#ANNUAL INCOME VS LIQUID NET WORTH PLUS#

In marketing and financial services, mass affluent and emerging affluent are the high end of the mass market, or individuals with US$100,000 to US$1,000,000 of liquid financial assets plus an annual household income over US$75,000.

0 kommentar(er)

0 kommentar(er)